How to Maximize Your Home Renovation Budget

Learn how to maximize your home renovation budget with smart planning, cost saving strategies, material choices, and tips that deliver the best value.

Embarking on a home improvement project is an exciting journey. It's your chance to transform your living space into the dream you've always envisioned. But before you pick up a hammer, you need a solid financial plan.

According to data from HomeAdvisor, the average cost for a significant project is around $49,979. The final amount you spend is heavily influenced by the size of your space. Costs can range from $10 to $150 per square foot.

Older properties often require more investment, especially if updates to wiring or plumbing are needed. Understanding these variables upfront helps you set realistic expectations. This prevents the stress of unexpected expenses later on.

This guide will walk you through creating a personalized financial strategy. You will learn proven methods for stretching your money further. Our goal is to help you achieve high-quality results without compromising your vision.

Getting Started on Your Renovation Vision

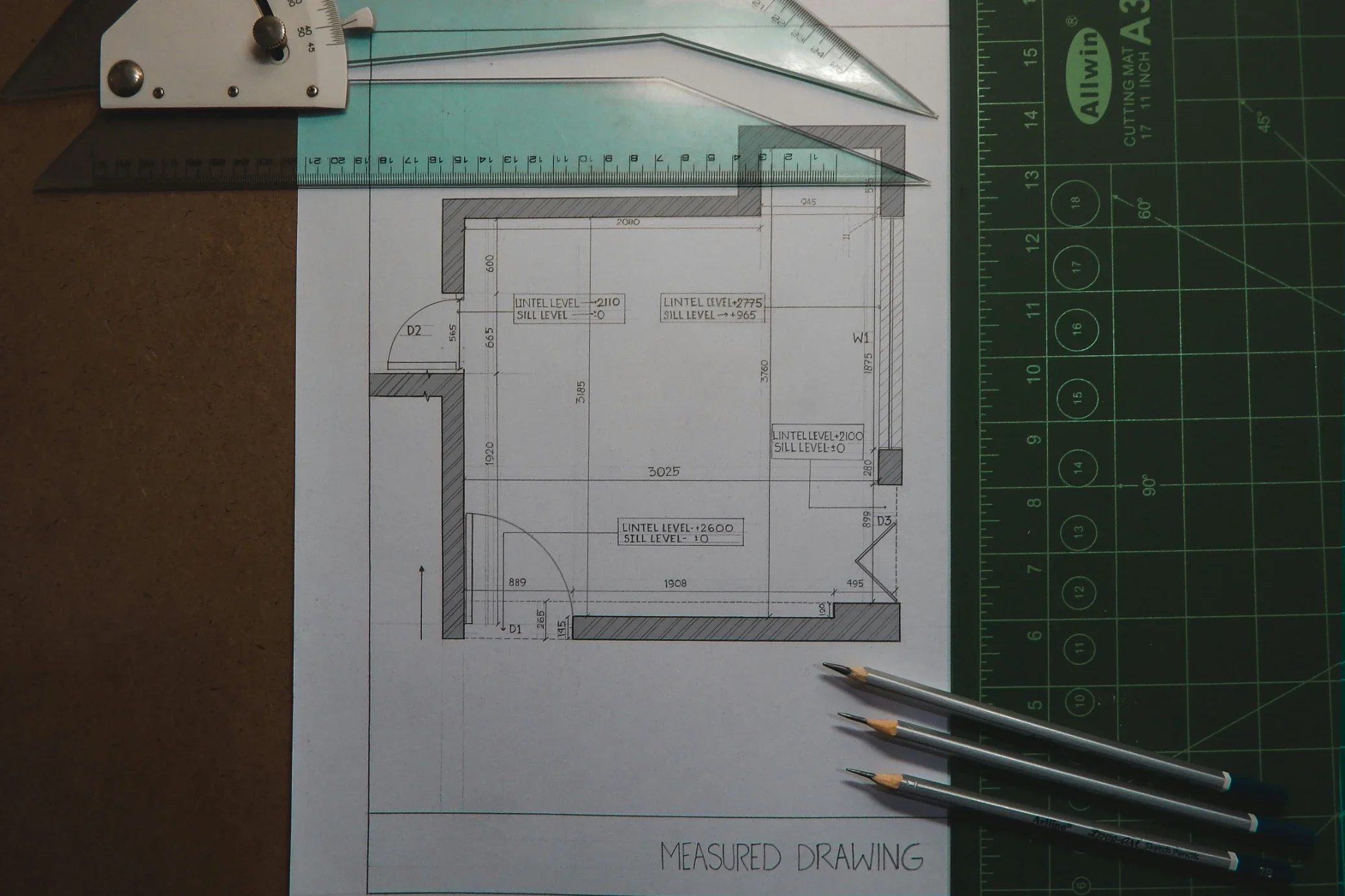

Before any construction begins, defining your objectives sets the foundation for everything that follows. A clear vision prevents expensive changes once work is underway.

This initial planning stage transforms vague ideas into actionable goals. It's where dreams meet practical reality.

Understanding Your Design Goals

Think beyond just how the space will look. Consider how you'll actually use each room daily.

Your design should serve your family's specific needs and lifestyle. Function matters as much as aesthetics for long-term satisfaction.

Identifying Key Project Priorities

Create a detailed list separating essential items from desirable extras. This becomes your compass when facing financial decisions.

Focus on layout and practical requirements first. This bottom-up approach ensures your plan serves your life rather than just fitting a number.

Defining Your Home Renovation Budget

Smart financial planning turns your vision into reality without breaking the bank. Start by looking at your property's total value. A good rule is to limit spending on any single space to 10-15% of this amount.

This approach prevents over-improving for your neighborhood. For example, with a $100,000 property, keeping the kitchen or bathroom costs under $15,000. This ensures your investment adds proportional value.

Understanding typical expenses for different areas gives you realistic expectations. Here are common price ranges:

Bathroom: $3,000-$25,000

Kitchen: $6,000+

Master bedroom: $10,000-$15,000

Living room: $5,000-$10,000

Your financing choice determines how much flexibility you have during the renovation. If savings are limited, you can look up home improvement loans near me and compare options that fit your budget and repayment comfort. Having a clear funding limit helps prevent overspending and keeps decisions practical.

Even with financing secured, setting aside 10–20% for unexpected costs is important. Surprise expenses like permits, repairs, or upgrades can appear quickly, and a buffer helps you stay in control throughout the project.

Breaking Down Renovation Costs

Creating a detailed line-by-line list is your next critical step in financial planning. This approach lets you track every dollar and find smart savings.

Seeing each expense separately helps you make informed choices. You maintain quality while controlling your overall spending.

Listing Materials, Labor, and Fixtures

Start by building a comprehensive spreadsheet for your project. Include estimated prices for labor and all required items.

Your materials list needs to be thorough. Remember both large and small purchases.

Big-ticket items: flooring, tile, cabinets, and appliances.

Essential supplies: paint, primer, rollers, brushes, and adhesives.

Fixtures and hardware: lighting, faucets, shower heads, and cabinet handles.

Tools and equipment: purchases or rentals for specific tasks.

For a kitchen or bathroom, account for cabinetry, countertops, and all plumbing fixtures. Get specific quotes for accuracy.

Estimating Unexpected Expenses

Even the best plans encounter surprises. Set aside 10% to 20% of your total financial plan for the unexpected.

This cushion covers hidden issues like outdated wiring or water damage. It also handles material price increases.

Planning for these potential expenses prevents stress. It ensures your project can continue smoothly to completion.

Choosing the Right Budgeting Method

The approach you take to allocate funds can significantly influence the outcome of your improvement efforts. Picking a strategy that fits your mindset is crucial for a smooth process.

It helps you manage costs while staying true to your vision for the space.

Top-Down vs. Bottom-Up Budgeting

You have two primary paths. The top-down method starts with a fixed amount of money. Every subsequent choice must fit within that predetermined limit.

This works well when finances are tight. However, it can force you to compromise on important elements.

The bottom-up way is different. You first list all your must-haves and design wishes. Then, you calculate the total cost to bring that ideal plan to life.

This second approach gives you a clear picture based on your specific needs. Your financial plan isn't a guess. It's built from real quotes for your unique situation.

For instance, you might find your dream kitchen costs $25,000. You can then strategically adjust elements to meet a $20,000 goal.

When to Adjust Your Plan

Your initial financial outline is a starting point, not a final decree. Be ready to update it at key moments.

This often happens after receiving bids from a contractor. Unexpected issues discovered during work are another common trigger.

Finding a beautiful alternative that costs less is a great reason to change your plan. Having honest talks about priorities ensures you spend your money wisely.

Sometimes, waiting for a sale is worth the extra time to get what you truly love.

DIY Tips and Cost-Saving Strategies

Rolling up your sleeves for some hands-on work offers both financial benefits and personal satisfaction during your space transformation. Knowing which tasks you can safely tackle yourself helps stretch your dollars further.

Be honest about your skill level and available time. This prevents costly mistakes that require professional fixes.

Selecting Projects to DIY

Start with demolition work like removing cabinets or pulling up old flooring. These tasks require muscle and safety gear rather than specialized skills.

Painting is another excellent DIY opportunity. Professionals often charge $300 or more per room.

Consider these beginner-friendly options for your project list:

Wall painting and surface preparation

Furniture assembly and curtain rod installation

Creating custom wall art and window treatments

Tile laying after practicing on small sections

Building your own furniture pieces like vanities or shelving saves significant money. You can start these months before your main work begins.

Smart Ways to Shop for Materials

Strategic purchasing makes a big difference in your final costs. Compare prices across multiple retailers and wait for seasonal sales.

Explore secondhand options through Facebook Marketplace or Craigslist. Gently used appliances and finishes can dramatically reduce your spend.

Follow these shopping strategies:

Use cut optimizers to minimize material waste

Buy in bulk when possible for better pricing

Ask for contractor discounts even as a DIYer

Consider budget-friendly alternatives with similar aesthetics

Remember to allocate money for supplies and tools in your financial plan. Even DIY work requires proper materials for professional results.

Integrating Spreadsheets and Budget Tools

A powerful digital tool can transform your financial tracking from a chore into a strategic advantage. Using a dedicated budget spreadsheet provides a clear framework to manage all your expenses.

This approach gives you instant visibility into your spending. You can make informed decisions to keep your project on track.

Using Editable Budget Templates

Free templates are a great starting point. They often come with pre-built worksheets for different spaces like kitchens and bathrooms.

These sheets list common line items for each type of room. You can easily customize the template by adding or removing specific costs.

A well-organized budget spreadsheet typically divides expenses into logical categories:

Room Upgrades for permanent fixtures

DIY Projects for materials and tools

Furnishings for furniture and decor

Contingency for unexpected costs

Some templates even include helpful calculators. A tile estimator, for example, helps you buy the right amount of material and avoid waste.

Tracking Expenses in Real Time

The real power of a budget spreadsheet comes from consistent updates. Enter every purchase, no matter how small, into the "spent" column immediately.

This habit ensures you always know your exact financial standing. It prevents small expenses from adding up to a big surprise.

Comprehensive tools like the Easy Renovation Planner offer even more features. They can track contractor bids and manage shopping lists in one place.

This digital record is invaluable for insurance, taxes, or future reference. It turns your planning into a lasting asset for your property.

Expert Advice for a Successful Renovation

Seasoned contractors and designers offer strategic insights that help you make smart choices throughout your space upgrade. Their wisdom guides you toward quality results while maximizing your investment.

Insights on Prioritizing Splurge vs. Save

Knowing when to splurge and when to save can make a major difference in both your renovation results and your long-term costs.

Always invest in professional work behind walls: Hire qualified electricians and plumbing experts for hidden systems. Fixing failures later costs much more than doing it right initially.

Focus your splurges on high-use fixtures and furniture: In the kitchen, quality appliances matter most. For bathrooms, prioritize shower fixtures and faucets that get daily use.

Lighting deserves special attention: Even beautiful designs fall flat without proper illumination. Invest in quality light sources that add both function and character.

Save money through strategic DIY work: Handle demolition and site preparation yourself. Consider painting or simple tile laying as beginner-friendly projects.

Financing Options and Contractor Bids

Start by reviewing the financing options available for your renovation. Home equity loans often come with lower interest rates, while personal loans can provide quicker access to funds, though usually at a higher cost. Understanding your budget range early helps set realistic expectations.

Once your financing is clear, gather bids from at least three contractors. Take time to interview each one, review past work, and check references. Being open about your budget allows contractors to create proposals that align with your financial plan.

Avoid choosing a contractor based only on the lowest price. Extremely low bids can signal rushed work or hidden shortcuts. Instead, compare estimates carefully and use competing bids as leverage to negotiate fair pricing with the professional you trust most.

Conclusion

You now possess the complete toolkit needed to navigate your property upgrade with financial wisdom and confidence. This guide has provided a clear roadmap from initial vision to final execution, ensuring every dollar works effectively toward your goals.

Your improvement success hinges on thorough preparation and honest self-assessment. Using tracking systems and getting multiple bids will keep your project aligned with realistic expectations.

Remember that smart financial planning enhances rather than restricts your creative vision. By implementing these strategies, you'll create a beautiful space that serves your family's needs while protecting your financial wellbeing for years to come.