Why More Homeowners Are Choosing a Consumer Green Loan Program

Discover why homeowners are turning to consumer green loan programs to finance energy-efficient upgrades and eco-friendly home improvements with ease!

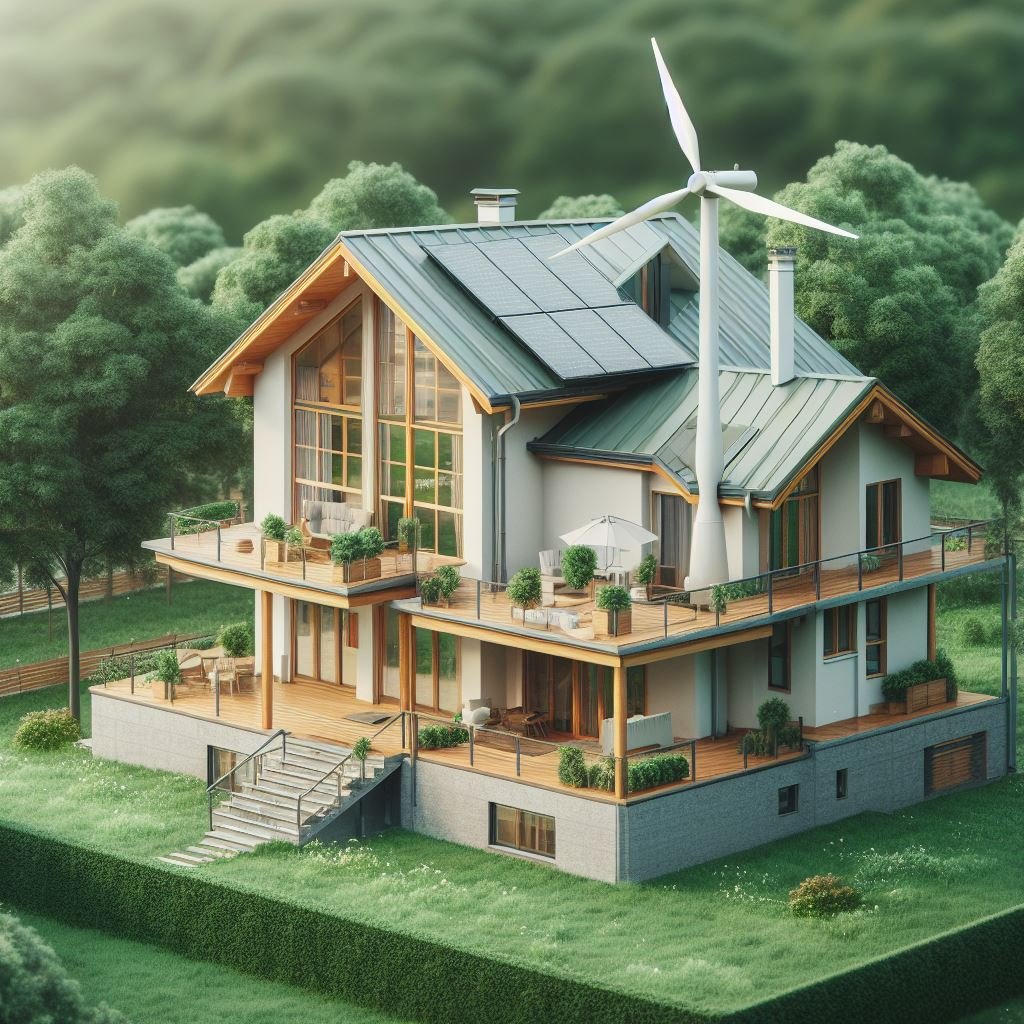

Over the years, more homeowners have been focusing on green living. With the rise of environmental awareness in society, many people are looking for sustainable alternatives to reduce their carbon footprint. A popular method used for this purpose is the consumer green loan program. It is a financial tool that allows not only improving energy efficiency at home but also has economic benefits.

If you are considering getting a consumer green loan program, here’s your guide outlining why it is a good idea. So, read on and gain valuable insights.

Understanding Consumer Green Loan Programs

Green loan programs are focused on the environment. These plans allow homeowners to make green home improvements, like installing solar panels, energy-efficient windows, or renewable heating systems. These upgrades help preserve the natural environment and account for substantial savings on utility bills. These loans are making sustainable living accessible to a wider range of people.

Financial Incentives

Green loan programs are financially incentivized, and this is one of the most compelling reasons to select them. It is also true that the interest rates for many programs are very low, and the repayment plans for those programs are incredibly flexible. These financial incentives help to make green upgrades more attainable for homeowners, enabling them to invest in the property without breaking the bank. Eventually, the utility savings can pay back the upfront costs to give you an economic benefit over the long term.

Cost Savings and Energy Efficiency

Consumer green loans, which finance energy efficiency investments, can generate significant cost savings. To give you an example, fitting energy-efficient appliances can significantly reduce your electricity usage. Likewise, installing solar panels can help reduce dependence on conventional energy. Many homeowners see a dramatic decrease in their energy bills, leading to a more sustainable lifestyle and a better overall financial soundness factor.

Environmental Impact

This is an irreversible environmental footprint that green loan programs continually keep putting in. Homeowners are going green and helping to lower the carbon footprint by borrowing for energy-efficient repairs. Such a proactive approach can combat climate change by reducing reliance on non-renewable sources of energy. Additionally, green improvements help create a cleaner living atmosphere by enhancing indoor air and water quality and decreasing pollution.

Increased Property Value

Green renovations have been proven to add serious value to a property. In a world where sustainable homes are gaining popularity, homes with energy-efficient features make a much better impression on potential buyers. Not only does a green loan program make the home more enjoyable to live in, but it also helps increase the home's resale value. The combination of these two advantages means that financial schemes like these are attractive to a homeowner looking to make a prudent investment.

Implementation of Government Schemes

More and more governments across the world are supporting sustainable living. Most of the green loan programs tie in with these national objectives and thus assist national and local governments with their environmental objectives. Homeowners are a part of something bigger, and everyone is doing their share in what they can to contribute to the initiatives.

Challenges and Considerations

Homeowners need to consider the challenges that come with choosing a loan, such as a green loan, despite the advantages of green loans. Some programs may have specific criteria and/or certifications required for eligibility. It is important to explore the options available and understand the terms of committed or uncommitted letters of credit. Talking to financial advisers or access specialists in sustainable living can help with understanding so that the decisions you make are from an informed perspective.

Conclusion

This transition to sustainability represents a landmark shift in the global battle against environmental problems. For homeowners willing to do their part in these efforts, consumer green loan programs are a real-world solution. The advantages are clear—financial perks, energy efficiency, and property appreciation. The eco-friendly upgrades create beautiful living areas and are an important step in creating a more sustainable future. With an increasing number of homeowners realizing this benefit, green loan programs are taking off. They will likely keep climbing in popularity and help to continue making a greener planet for generations to come.